Contents

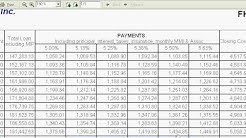

Reverse Mortgage Amortization Calculator Excel – Use this mortgage calculator to estimate your monthly home loan payment, and to breakdown your monthly mortgage repayments into a simple, flexible, and printable amortization schedule and chart. Use it to calculate government (fha, VA and USDA) or conventional mortgages..

The $8 million fixed-rate loan carries a 10-year term with three years of interest only payments and a 30-year amortization period. having ranked as a top FHA, Fannie Mae, and Freddie Mac lender in.

interest for personal loan We can examine, objects, similar to monetary in addition to fiscal interest, as well as Money Tree Renton Wa preparedness, needed and also necessary, not to mention good, for anyone, looking at getting a dwelling, that belongs to them, so that you can consider. Even though good Consumer Loan To Payday South Carolina Sc judgment, shows, most are fundamental, etc.

Be Smart When it Comes to Your Mortgage. FHA loans are insured by the federal housing administration. qualified borrowers can expect lower down payments and credit requirements than what is typically required with conventional loans. The minimum down payment requirement for an FHA loan is only 3.5%.

The minimum loan amount for FHA is $1M and there is no maximum loan amount. FHA offers a higher LTV, term, and amortization than most institutions. Max LTV for FHA runs around 83%. Term Length is usually between 30-40 years while the amortization is also falling between 30-40 years. For more information please visit our FHA Loans page.

The minimum loan amount for FHA is $1M and there is no maximum loan amount. FHA offers a higher LTV, term, and amortization than most institutions. Max LTV for FHA runs around 83%. Term Length is usually between 30-40 years while the amortization is also falling between 30-40 years. For more information please visit our FHA Loans page.

A mortgage amortization calculator like this one can help you determine. you can drop the mortgage insurance once your loan-to-value ratio drops to 80% or less. However, with an FHA loan, mortgage.

“The UFMIP charged for all amortization terms is 175 basis points (bps), could be Streamline or cash-out/no-cash-out FHA refinance loans.

refinance conventional loan to fha cons of fha loan google mortgage comparison volunteer home mortgage Broker in Maryville, TN – The Bottom Line. The bottom line is that most mortgage brokers have invaluable connections in the real estate industry, which means that they are better able to help you get a good deal on mortgage loan.Here at Volunteer Home Mortgage Inc., we work with you by assessing your individual situation and providing you with customized home loan options to choose from.When compared to conventional loans, FHA loans are typically easier to qualify for. The FHA makes homeownership accessible to people of all income levels. With the government guaranteeing the loan, lenders are more willing to approve applications. check with several lenders: Lenders can (and do).Millennials entering the housing market are mostly bypassing federal housing administration (fha)-backed mortgages, according to new data from Ellie Mae. In an analysis of mortgage data culled during.

but may also negatively impact FHA’s Mutual Mortgage Insurance fund due to the immediate increase in loan margins, “thus immediately increasing loan balance negative amortization in a low interest.

Which Is Higher usda loans vs fha Ideal for borrowers who are looking to apply for a mortgage and manage the process through online tools, whether buying or refinancing. Guaranteed Rate offers FHA, VA and USDA loans for borrowers who.But the town is modernising at a pace, with the recent announcement that it will be receiving a share of the Government’s.

The Benefits of Getting a Loan from Quicken Loans We’re an FHA-approved lender and process FHA loans every day. You get a completely online application with less paperwork. Home Loan Experts are available via chat, email and phone to help you understand whether an FHA loan is right for you.